- Production of Crude Oil

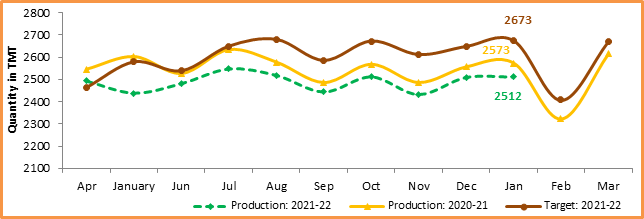

Crude oil production[1] during January 2022 was 2511.66 TMT, which is 6.04% lower than target for the month and 2.40% lower than the production of January 2021. Cumulative crude oil production during April-January, 2021-22 was 24890.07 TMT, which is 4.63% and 2.61% lower than target for the period and production during corresponding period of last year respectively. Unit-wise and State-wise crude oil production is given at Annexure-I. Unit-wise crude oil production for the month of January 2022 and cumulatively for April-January 2021-22 vis-à-vis same period of last year has been shown in Table-1 and month-wise in Figure-1.

Table-1: Crude Oil Production (in TMT)

|

Oil Company |

Target |

January (Month) |

April-January (Cumulative) |

||||||

|

2021-22 (Apr-Mar)* |

2021-22 |

2020-21 |

% over last year |

2021-22 |

2020-21 |

% over last year |

|||

|

Target* |

Prod.* |

Prod. |

Target* |

Prod.* |

Prod. |

||||

|

ONGC |

20272.88 |

1726.31 |

1662.79 |

1715.74 |

96.91 |

16988.50 |

16259.10 |

16924.83 |

96.07 |

|

OIL |

3182.60 |

282.72 |

255.32 |

242.58 |

105.25 |

2635.02 |

2499.16 |

2469.27 |

101.21 |

|

PSC Fields |

7718.52 |

664.02 |

593.56 |

615.07 |

96.50 |

6475.29 |

6131.80 |

6162.71 |

99.50 |

|

Total |

31173.99 |

2673.04 |

2511.66 |

2573.38 |

97.60 |

26098.81 |

24890.07 |

25556.80 |

97.39 |

Note: Totals may not tally due to rounding off. *: Provisional

Figure-1: Monthly Crude Oil Production

Unit-wise production details with reasons for shortfall are as under:

-

- Crude oil production by ONGC (Oil and Natural Gas Corporation) in nomination block during January 2022 was 1662.79 TMT, which is 3.68% lower than target of the month and 3.09% lower when compared with production of January 2021. Cumulative crude oil production by ONGC during April-January, 2021-22 was 16259.10 TMT, which is 4.29% and 3.93% lower than target for the period and production during corresponding period of last year respectively. Reasons for shortfall in production are as under:

- Less than anticipated production from WO-16 cluster due to delay in mobilization of MOPU Sagar Samrat.

- Less than anticipated production from Cluster-8 fields due to delay in inputs as installation of wellhead platforms got delayed due to Covid impact.

- Loss in oil production in Ratna & R-Series due to scaling in wells and delay in H2S package at R-13A wells.

- Less condensate receipt at Hazira due to less gas production from B&S Asset.

-

- Crude oil production by OIL (Oil India Ltd) in the nomination block during January 2022 was 255.32 TMT, which is 5.25% higher when compared with production of January 2021 but 9.69% lower than target of the month. Cumulative crude oil production by OIL during April-January 2021-22 was 2499.16 TMT, which is 1.21% higher than the production during corresponding period of last year but 5.16% lower than target for the period. Reasons for shortfall in production are as under:

- Less than planned contribution from workover wells and drilling wells.

- Less than planned due to local disturbance & miscreants activities in main producing area (MPA).

-

- Crude oil production by Pvt/JVs companies in the PSC/RSC regime during January 2022 was 593.56 TMT, which is 10.61% lower than the target of the reporting month and 3.50% lower than the month production of January 2021. Cumulative crude oil production by Pvt/JVs companies during April-January 2021-22 was 6131.80 TMT, which is 5.30% and 0.50% lower than target for the period and production during corresponding period of last year respectively. Reasons for shortfall in production are as under:

- MB/OSDSF/B80/2016 (Hindustan Oil Exploration Company Ltd.): Delay in commencement of production. Pre-commissioning in progress.

- RAVVA (Cairn Energy India Ltd): Production shortfall due to lower performance of wells RD-3ST and RD-6ST due to infectivity issues.

- CB-ONN-2004/2 (ONGC): Production shortfall due to less evacuation to IOCL due to leakage and choking in ONGC pipeline.

- CB-OS/2 ((Cairn Energy India Ltd): Production shortfall is due to natural decline and increase in water cut observed in aquifer supported pools and recent sanding/loading issues in the wells.

- Production of Natural Gas

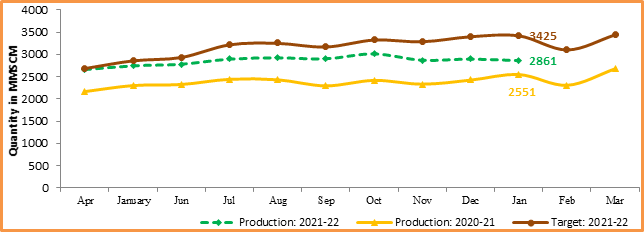

Natural gas production during January 2022 was 2861.09 MMSCM, which is 12.17% higher than the production of January 2021 but 16.47% lower than the monthly target. Cumulative natural gas production during April-January 2021-22 was 28535 MMSCM, which is 20.50% higher than production during corresponding period of last year but 9.59% lower when compared with target for the period. Unit-wise and state-wise natural gas production is given at Annexure-II. Unit-wise natural gas production for the month of January 2022 and cumulatively for April-January 2021-22 vis-à-vis same period of last year has been shown in Table-2 and month-wise in Figure-2.

Table-2: Natural Gas Production (in MMSCM)

|

Oil Company |

Target |

January (Month) |

April-January (Cumulative) |

||||||

|

2021-22 (Apr-Mar)* |

2021-22 |

2020-21 |

% over last year |

2021-22 |

2020-21 |

% over last year |

|||

|

Target* |

Prod.* |

Prod. |

Target* |

Prod.* |

Prod. |

||||

|

ONGC |

23335.10 |

2000.05 |

1749.35 |

1865.72 |

93.76 |

19488.61 |

17291.18 |

18410.04 |

93.92 |

|

OIL |

2949.65 |

250.00 |

232.98 |

211.95 |

109.92 |

2472.91 |

2422.75 |

2081.78 |

116.38 |

|

PSC Fields |

11834.60 |

1175.19 |

878.76 |

473.01 |

185.78 |

9600.67 |

8821.07 |

3187.82 |

276.71 |

|

Total |

38119.35 |

3425.25 |

2861.09 |

2550.68 |

112.17 |

31562.19 |

28535.00 |

23679.64 |

120.50 |

Note: Totals may not tally due to rounding off. *: Provisional

Figure-2: Monthly Natural Gas Production

-

- Natural gas production by ONGC in the nomination blocks during January 2022 was 1749.35 MMSCM, which is 12.53% lower than target for the month and 6.24% lower than the production of January 2021. Cumulative natural gas production by ONGC during April-January, 2021-22 was 17291.18 MMSCM, which is 11.28% and 6.08% lower than target for the period and production during corresponding period of last year respectively. Reasons for shortfall in production are as under:

- Less than anticipated production from WO-16 cluster due to delay in mobilization of MOPU Sagar Samrat.

- Less than planned production from Vasistha /S1 wells in EOA due to certain reservoir related issues.

- Delay in commencement of gas production from U1 field of KG-98/2 Cluster-II due to covid impact as manufacturing of subsea items and well completion got delayed.

- Less production due to decline in Tapti-Daman block in B&S Asset.

-

- Natural gas production by OIL in the nomination block during January 2022 was 232.98 MMSCM which is 9.92% higher than target for the month and 6.81% lower than the production of January 2021. Cumulative natural gas production by OIL during April-January 2021-22 was 2422.75 MMSCM, which is 16.38% higher than production during corresponding period of last year but 2.03% lower than target for the period. Shortfall in production is due to less than planned contribution from workover wells and drilling wells.

-

- Natural gas production by Pvt/JVs companies in the PSC/RSC/CBM regime during January 2022 was 878.76 MMSCM, which is 85.78% higher than the production of January 2021 but 25.22% lower than the target for the month. Cumulative natural gas production by Pvt/JVs during April-January, 2021-22 was 8821.07 MMSCM, which is 176.71% higher than production during corresponding period of last year but 8.12% lower than target for the period. Reasons for shortfall in production are as under:

- KG-DWN-98/2 (ONGC): Delay in commencement of production. Pre-commissioning in progress.

- KG-DWN-98/3 (RIL): Production shortfall due to well intervention jobs in some wells.

- RJ-ON-90/1 (Cairn Energy India Ltd): Few Gas wells of RDG field are not producing as per expectations.

- RANIGANJ EAST (Essar Oil and Gas Exploration and Production Ltd.): Shortfall because delay in scheduled operations.

- RJ-ON//6 (FEL): Production shortfall due to less offtake by customer.

- Crude Oil Processed (Crude Throughput)

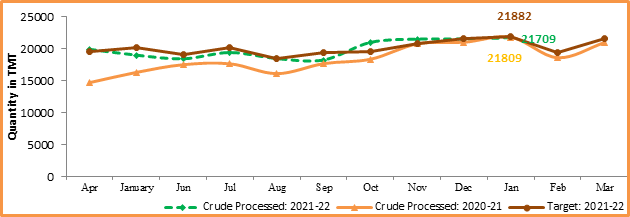

Crude Oil Processed during January 2022 was 21708.56 TMT, which is 3.03% lower than target for the month and 0.46% lower than the January 2021. Cumulative crude processed during April-January 2021-22 was 198923.79 TMT, which is 1.24 and 9.20% higher than target for the period and production during corresponding period of last year respectively. Refinery-wise details of the crude throughput and capacity utilization during the month of January 2022 vis-à-vis January 2021 are given at Annexure-III and Annexure-IV. Company-wise crude throughput for the month of January 2021 and cumulatively for the period April-January 2021-22 vis-à-vis same period of last year has been shown in Table-3 and month-wise in Figure-3.

Table 3: Crude Oil Processed (Crude Throughput) (in TMT)

|

Oil Company |

Target |

January (Month) |

April-January (Cumulative) |

|||||||

|

2021-22 (Apr-Mar)* |

2021-22 |

2020-21 |

% over last year |

2021-22 |

2020-21 |

% over last year |

||||

|

Target* |

Prod.* |

Prod. |

Target* |

Prod.* |

Prod. |

|||||

|

CPSE |

143300.54 |

13762.56 |

12876.14 |

13204.06 |

97.52 |

116065.59 |

111874.24 |

102932.72 |

108.69 |

|

|

IOCL |

69120.46 |

6791.00 |

5843.72 |

6278.12 |

93.08 |

56191.56 |

55243.43 |

51036.68 |

108.24 |

|

|

BPCL |

29801.53 |

2715.00 |

2752.96 |

2893.30 |

95.15 |

24380.53 |

24418.03 |

20788.41 |

117.46 |

|

|

HPCL |

17751.16 |

1579.64 |

1644.80 |

1438.94 |

114.31 |

14070.69 |

10923.44 |

13464.67 |

81.13 |

|

|

CPCL |

9130.00 |

998.39 |

915.07 |

917.46 |

99.74 |

7133.21 |

7049.89 |

6521.75 |

108.10 |

|

|

NRL |

2840.00 |

248.00 |

271.97 |

248.84 |

109.29 |

2368.00 |

2202.18 |

2239.35 |

98.34 |

|

|

MRPL |

14594.35 |

1425.00 |

1440.33 |

1419.84 |

101.44 |

11869.35 |

11974.68 |

8815.80 |

135.83 |

|

|

ONGC |

63.04 |

5.53 |

7.30 |

7.56 |

96.52 |

52.25 |

62.59 |

66.06 |

94.74 |

|

|

JVs |

18079.47 |

1514.50 |

1821.92 |

1495.73 |

121.81 |

15208.47 |

17036.26 |

14019.61 |

121.52 |

|

|

BORL |

7058.47 |

578.50 |

721.98 |

694.44 |

103.97 |

5968.47 |

6111.79 |

4986.03 |

122.58 |

|

|

HMEL |

11021.00 |

936.00 |

1099.94 |

801.29 |

137.27 |

9240.00 |

10924.47 |

9033.58 |

120.93 |

|

|

Private |

78008.07 |

7109.20 |

7010.49 |

7109.19 |

98.61 |

65218.19 |

70013.29 |

65218.19 |

107.35 |

|

|

RIL |

60940.96 |

5564.40 |

5277.05 |

5564.40 |

94.84 |

51174.65 |

53102.23 |

51174.65 |

103.77 |

|

|

NEL |

17067.11 |

1544.80 |

1733.44 |

1544.80 |

112.21 |

14043.54 |

16911.06 |

14043.54 |

120.42 |

|

|

TOTAL |

239388.08 |

22386.26 |

21708.56 |

21808.99 |

99.54 |

196492.25 |

198923.79 |

182170.52 |

109.20 |

|

Note: Totals may not tally due to rounding off. *: Provisional

Figure 3: Crude Oil Processed (Crude Throughput)

3.1 CPSE Refineries’ crude oil processed during January 2022 was 12876.14 TMT, which is 6.44% lower than target for the month and 2.48% lower than the production of January 2021. Cumulative crude throughput during April-January 2021-22 was 111874.24 TMT which is 8.69% lower than corresponding period of last year but 3.61% lower than target for the period. Reasons for shortfall in production are as under:

- IOCL-Haldia Refinery: Monthly Crude processed lower due to deferment of Crude Distillation Unit-2 (CDU) shutdown and Extension of CDU-2 shutdown.

- IOCL-Mathura & Panipat Refinery: Monthly Crude processed in line of products demand.

- IOCL-Bongaigaon Refinery: Monthly Crude processed in line of crude availability.

- IOCL-Paradip Refinery: Monthly crude processed marginally low due to leak in reaction furnace of Sulphur recovery unit.

- HPCL, Visakh Refinery: Monthly Crude processed lower due to shutdown of Primary Crude Processing Units.

- CPCL-Manali Refinery: Monthly Crude processed lower due to lower Bitumen/Petcoke upliftment.

3.2 JV refineries’ crude oil processed during January 2022 was 1821.92 TMT, which is 20.30% higher than the target for the month and 21.81% higher than January 2021. Cumulative crude throughput during April-January 2021-22 was 17036.26 TMT, which is 12.02% and 21.52% higher than target for the period and production during corresponding period of last year respectively.

3.3 Private refineries’ crude oil processed during January 2022 was 7010.49 TMT, which is 1.39% lower than the corresponding month of last year. Cumulative crude throughput during April-January 2021-22 was 70013.29 TMT, which is 7.35% higher than the corresponding period of last year.

- Production of Petroleum Products

-

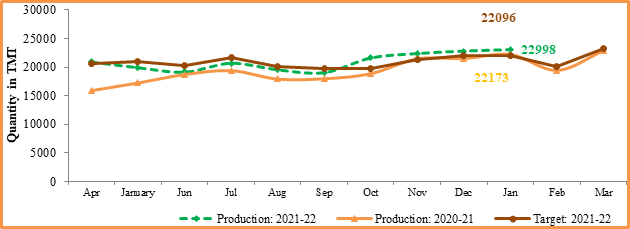

- Production of Petroleum Products during January 2021 was 22997.96 TMT, which is 3.55% higher than production of January 2021 and 3.72% higher than target for the month. Cumulative production during April-January, 2021-22 was 209006.59 TMT, which is 1.71% and 9.29% higher than target for the period and production during corresponding period of last year respectively. Unit-wise production of petroleum products is given at Annexure-V. Company-wise production for the month of January 2021-22 and cumulatively for April-January, 2021 vis-à-vis same period of last year has been shown in Table-4 and month-wise in Figure-4.

Figure 4: Monthly Refinery Production of Petroleum Products

Table 4: Production of Petroleum Products (TMT)

|

Oil Company |

Target |

January (Month) |

April-January (Cumulative) |

||||||

|

2021-22 (Apr-Mar)* |

2021-22 |

2020-21 |

% over last year |

2021-22 |

2020-21 |

% over last year |

|||

|

Target* |

Prod.* |

Prod. |

Target* |

Prod.* |

Prod. |

||||

|

CPSE |

135423.57 |

12617.32 |

12161.89 |

12536.36 |

97.01 |

110518.32 |

105927.22 |

97481.15 |

108.66 |

|

IOCL |

65757.60 |

6161.75 |

5602.18 |

6126.82 |

91.44 |

54011.23 |

53005.56 |

49048.58 |

108.07 |

|

BPCL |

27811.21 |

2558.84 |

2578.29 |

2684.05 |

96.06 |

22696.04 |

23293.33 |

19835.97 |

117.43 |

|

HPCL |

16583.96 |

1478.45 |

1522.96 |

1420.09 |

107.24 |

13142.69 |

10173.94 |

12580.36 |

80.87 |

|

CPCL |

9279.11 |

864.85 |

860.95 |

825.11 |

104.34 |

7633.11 |

6455.10 |

5955.69 |

108.39 |

|

NRL |

2839.03 |

247.92 |

272.87 |

252.95 |

107.88 |

2367.19 |

2165.08 |

2267.67 |

95.48 |

|

MRPL |

13092.62 |

1300.24 |

1317.71 |

1220.14 |

108.00 |

10618.31 |

10774.50 |

7729.59 |

139.39 |

|

ONGC |

60.02 |

5.27 |

6.92 |

7.21 |

96.01 |

49.75 |

59.71 |

63.29 |

94.34 |

|

JVs |

16813.56 |

1322.16 |

1651.08 |

1378.92 |

119.74 |

14161.02 |

15754.65 |

13002.12 |

121.17 |

|

BORL |

6547.56 |

539.16 |

647.61 |

598.49 |

108.21 |

5530.02 |

5441.70 |

4368.42 |

124.57 |

|

HMEL |

10266.00 |

783.00 |

1003.47 |

780.43 |

128.58 |

8631.00 |

10312.96 |

8633.70 |

119.45 |

|

Private |

93222.97 |

7907.34 |

8850.89 |

7907.34 |

111.93 |

77209.90 |

83893.87 |

77209.90 |

108.66 |

|

RIL |

76683.16 |

6429.86 |

7227.56 |

6429.86 |

112.41 |

63602.59 |

67649.24 |

63602.59 |

106.36 |

|

NEL |

16539.81 |

1477.48 |

1623.33 |

1477.48 |

109.87 |

13607.31 |

16244.63 |

13607.31 |

119.38 |

|

Total Refinery |

245460.10 |

21846.83 |

22663.86 |

21822.62 |

103.85 |

201889.24 |

205575.75 |

187693.17 |

109.53 |

|

Fractionators |

4331.28 |

363.33 |

334.10 |

350.53 |

95.31 |

3609.63 |

3430.84 |

3550.95 |

96.62 |

|

TOTAL |

249791.38 |

22210.16 |

22997.96 |

22173.16 |

103.72 |

205498.88 |

209006.59 |

191244.12 |

109.29 |

Note: Totals may not tally due to rounding off. *: Provisional

-

- Production of petroleum Products by Oil’s Refineries during January 2022 was 22663.86 TMT, which is 3.74% higher than production of January 2021 and 3.85% higher when compared with target for the month. Cumulative production during April-January, 2021-22 was 205575.75 TMT, which is 1.83% and 9.53% higher than target for the period and production during corresponding period of last year respectively.

-

- Production of petroleum Products by Fractionators during January 2022 was 334.10 TMT, which is 8.05% lower than the target for the month and 4.69% lower than production of January 2021. Cumulative production during April-January, 2021-22 was 3430.84 TMT, which is 4.95% and 3.38% lower than target for the period and production during corresponding period of last year respectively.

Click here to see Annexure III

YB/RM

***********