The Central Board of Direct Taxes (CBDT), Ministry of Finance, along with its subordinate offices across India, enthusiastically took part in the Special Campaign for Disposal of Pending Matters (SCDPM) 3.0. The Special Campaign was organised in two phases – Preparatory Phase from 14th September, 2023 to 30th September, 2023 and the Implementation Phase from 2nd October, 2023 to 31st October, 2023.

The Government of India undertook Special Campaign 3.0 in government offices and disposal of pending matters from 2nd October, 2023 to 31st October, 2023, on the lines of the Special Campaign held in 2022. The Special Campaign 3.0 covered all Ministries/ Departments of Government of India.

During the Preparatory Phase of Special Campaign 3.0, officers were sensitised, ground functionaries were mobilised, nodal officers were appointed, campaign sites were finalised and scrap/ redundant materials were identified. Further, pendency in specific categories including public grievances, grievance appeals, etc. was identified.

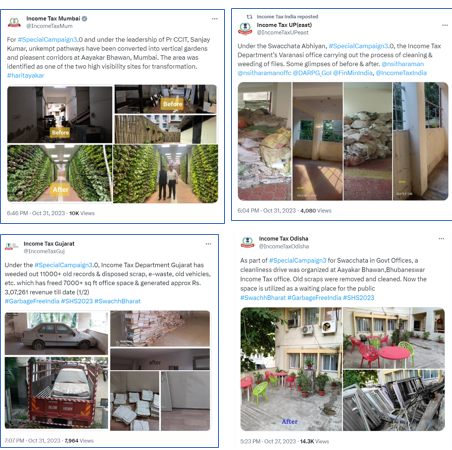

During the Implementation Phase, all out efforts were made to dispose-off all identified references and to improve the overall cleanliness of Income Tax offices. The efforts of the CBDT in the Special Campaign 3.0 were widely disseminated through media, including social media. Progress of the campaign was monitored on a daily basis.

The Special Campaign 3.0 has seen remarkable achievement on all parameters of the targets set by the CBDT. Initially, 505 sites were identified for conducting the cleanliness campaign. However, the CBDT achieved saturation of Swachhata and conducted 966 cleanliness campaigns across India, which include campaigns conducted in field offices at urban and suburban locations. Record management in offices was also attended to on priority, and more than 1,74,158 files were weeded out. Under this campaign, office scrap was disposed of, which generated revenue of more than Rs. 53 lakh and freed up space of around 1,08,740 sq. ft. Special efforts were also made to utilise the freed-up space for productive purposes. In addition to this, beautification of reclaimed office spaces to enhance the work environment was also undertaken.

Further, 40,003 public grievances were resolved and 2,230 public grievance appeals were disposed off during the implementation period.

The Department had encouraged different regions to come up with unique and innovative practices under the Special Campaign 3.0. Nine of such practices were recognised as ‘Best Practices’ during the Campaign period and reported on the SCDPM portal of the Special Campaign.

One of the best practices was the launch of an e-learning course on the Grievance Redressal Mechanism in Income Tax Department on iGOT platform of Karmayogi Bharat. This digital e-learning course was inaugurated by Union Finance Minister Smt. Nirmala Sitharaman, and is expected to build capacity of the officers and officials of the Department in public grievance redressal. This best practice has been recognised by DARPG, the nodal Department for Special Campaign 3.0 as the foremost best practice amongst all best practices across Ministries/Departments.

Another best practice identified during the campaign was the conversion of a storage dump at Aaykar Bhavan, Pune into a Library-cum-meeting place.

Third best practice was the adoption of a backward village namely Gongloor in District Sangareddy, Telangana, by IRS Officers for its all-round development and making it a self-reliant village. A Market Yard-cum-Sports Academy was developed here, which has various facilities like cricket nets, badminton and volleyball court, and kid’s play area. These facilities are run by the villagers themselves.

The Department highlighted another best practice which was the reclamation of an abandoned residential complex at Khaliamari, Dibrugarh, North East Region, which was earlier being used as a garbage dumping ground by residents and shopkeepers of the area.

Besides these, an innovative green practice was started in Aaykar Bhawan, Chandigarh where the residue of coffee beans used for making coffee in the Aaykar Bhawan café was used as an organic fertiliser for the flora in the building.

Other best practices under Special Campaign 3.0 include conversion of an unused patch of land into “Jaaswandh”, a lush green corridor under “Harit Aaykar” initiative at Aaykar Bhavan, Mumbai; beautification of the NCRB, Jaipur, building by installing ‘Vertical Gardens’ on ground, first and third floors covering total area of 910 Sq. Ft.; installation of a 100 KW Grid Connected Rooftop Solar project at Kautilya Bhavan, Mumbai for the reduction of carbon footprint; and inauguration of a venue for events, community gatherings, and social activities, with a capacity for seating 250+ persons on the rooftop of Aaykar Bhawan, Bhopal. These efforts form part of the best practices undertaken by the Department in the Special Campaign 3.0.

CBDT also used social media effectively to conduct outreach campaigns and highlight its initiatives under the Swachhata Abhiyan. More than 650 Tweets have been pos ted/reposted during the campaign on X platform by the official social media handle of the Income Tax Department, regional handles of Principal Chief Commissioner regions and the National Academy of Direct Taxes (NADT), to promote awareness for Swachhata campaigns. The campaign has also been amplified on other social media platforms of the CBDT.

CBDT reiterates its commitment to make Swachhata a habit and to continue to undertake cleanliness programmes from time to time, while also focus on expeditious disposal of public grievances in a timely manner.

****

NB/VM/KMN