- Production of Crude Oil

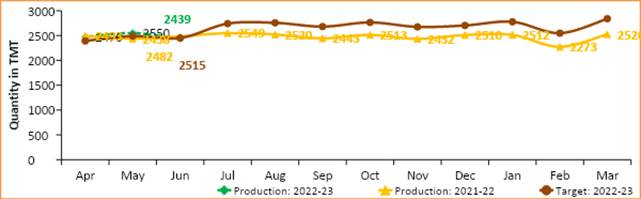

Crude oil production during June 2022 was 2439.32 TMT, which is 3.01% lower than target for the month and 1.71% lower than the production of June 2021. Cumulative crude oil production during April-June, 2022 was 7459.22 TMT, which is 1% lower than target for the period but 0.62% higher than production during corresponding period of last year respectively. Unit-wise and State-wise crude oil production is given at Annexure-I. Unit-wise crude oil production for the month of June 2022 and cumulatively for April-June 2021-22 vis-à-vis same period of last year has been shown in Table-1 and month-wise in Figure-1.

Table-1: Crude Oil Production (in TMT)

|

Oil Company |

Target |

June (Month) |

April-June (Cumulative) |

||||||

|

2022-23 (Apr-Mar)* |

2022-23 |

2021-22 |

% over last year |

2022-23 |

2021-22 |

% over last year |

|||

|

Target* |

Prod.* |

Prod. |

Target* |

Prod.* |

Prod. |

||||

|

ONGC (Nomination Block) |

19869.61 |

1643.50 |

1625.29 |

1621.92 |

100.21 |

4987.83 |

4969.63 |

4812.14 |

103.27 |

|

OIL (Nomination Block) |

3571.00 |

274.72 |

257.17 |

246.52 |

104.32 |

804.49 |

773.85 |

742.34 |

104.24 |

|

Pvt/JVs (PSC/RSC Regime) |

7400.88 |

596.69 |

556.86 |

613.32 |

90.79 |

1742.47 |

1715.74 |

1858.52 |

92.32 |

|

Total |

30841.49 |

2514.92 |

2439.32 |

2481.75 |

98.29 |

7534.79 |

7459.22 |

7413.00 |

100.62 |

- Note: Totals may not tally due to rounding off. *: Provisional

Figure-1: Monthly Crude Oil Production

Unit-wise production details with reasons for shortfall are as under:

- Crude oil production by ONGC (Oil and Natural Gas Corporation) in nomination block during June 2022 was 1625.29 TMT, which is 1.11% lower than target of the month and 0.21% higher when compared with production of June 2021. Cumulative crude oil production by ONGC during April-June, 2022 was 4969.63 TMT, which is 0.36% lower than target for the period but 3.27% higher than target for the period and production during corresponding period of last year respectively. Production is mainly lower due to lower condensate generation in Bassein and Tapti Daman area.

- Crude oil production by OIL (Oil India Ltd) in the nomination block during June 2022 was 257.17 TMT, which is 6.39% lower than the target of the month but 4.32% higher when compared with production of June, 2021. Cumulative crude oil production by OIL during April-June 2022 was 773.85 TMT, which is 3.81% lower than target for the period but 4.24% higher when compared production during corresponding period of last year. Reasons for shortfall in production are as under:

- Less than planned contribution from workover wells.

- Loss due to miscreant activities in Main Producing Area (MPA).

- Crude oil production by Pvt/JVs companies in the PSC/RSC regime during June 2022 was 556.86 TMT, which is 6.68% lower than the target of the reporting month and 9.21% lower than the month production of June 2021. Cumulative crude oil production by Pvt/JVs companies during April-June 2022 was 1715.74 TMT, which is 1.53% and 7.68% lower than target for the period and production during corresponding period of last year respectively. Reasons for shortfall in production are as under:

- CB-OS/2 (VEDANTA): Shortfall due to delay in Drilling campaign.

- MB/OSDSF/B80/2016 (HOEC) Production shortfall due to D1 well is shut-in due to operational issues and Plant shut-down multiple times due to process shut-down.

- RAVVA (VEEDANTA): Production shortfall due to RE wells were shut for rig move activities, leading to reduced monthly realization and Increased water cut in RE-5

- RJ-ON-90/1 (VEDANTA): Production shortfall due to Few well failures in ABH & NL; Well failures and higher injection losses to de risk infill drilling in Bhagyam. Some well shut-in due to SRP pump issues in Guda, Kaameshwari West, Raaggeshwari Oil.

- CB-ONN-2000/1 (GSPC): Few wells not producing due to possible casing damage, snapped/unscrewed sucker rod string.

- Production of Natural Gas

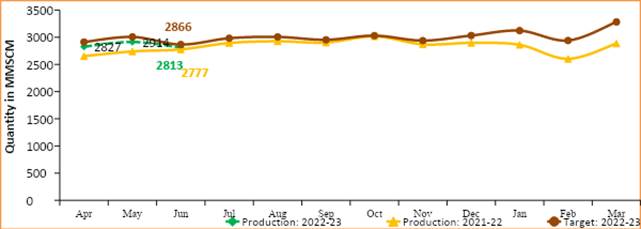

Natural gas production during June 2022 was 2812.78 MMSCM, which is 1.85% lower than the monthly target but 1.29% higher than production of June 2021. Cumulative natural gas production during April-June 2022 was 8553.16 MMSCM, which is 2.63% lower when compared with target for the period but 4.71% higher than production during corresponding period of last year. Unit-wise and state-wise natural gas production is given at Annexure-II. Unit-wise natural gas production for the month of June 2022 and cumulatively for April-June 2021-22 vis-à-vis same period of last year has been shown in Table-2 and month-wise in Figure-2.

Table-2: Natural Gas Production (in MMSCM)

|

Oil Company |

Target |

June (Month) |

April-June (Cumulative) |

||||||

|

2022-23 (Apr-Mar)* |

2022-23 |

2021-22 |

% over last year |

2022-23 |

2021-22 |

% over last year |

|||

|

Target* |

Prod.* |

Prod. |

Target* |

Prod.* |

Prod. |

||||

|

ONGC (Nomination Block) |

20381.94 |

1627.43 |

1637.24 |

1684.40 |

97.20 |

5076.75 |

5086.56 |

5051.93 |

100.69 |

|

OIL (Nomination Block) |

3717.84 |

305.55 |

246.75 |

230.14 |

107.22 |

924.79 |

742.78 |

675.20 |

110.01 |

|

Pvt/JVs (PSC/RSC Regime) |

11968.32 |

932.86 |

928.80 |

862.44 |

107.69 |

2782.31 |

2723.82 |

2441.02 |

111.59 |

|

Total |

36068.10 |

2865.83 |

2812.78 |

2776.98 |

101.29 |

8783.85 |

8553.16 |

8168.15 |

104.71 |

Note: Totals may not tally due to rounding off. *: Provisional

Figure-2: Monthly Natural Gas Production

- Natural gas production by ONGC (Oil and Natural Gas Corporation) in the nomination blocks during June 2022 was 1637.24 MMSCM, which is 0.6% higher target for the month but 2.8% lower than the production of June 2021. Cumulative natural gas production by ONGC during April-June, 2022 was 5086.56 MMSCM, which is 0.19% and 0.69% higher than target for the period and production during corresponding period of last year respectively.

- Less Free gas production in MH field and normalization of gas throughput towards Uran after hook up jobs for new slug catcher, leading to less sweet gas towards Hazira side.

- Delay in HF in Mandapeta & Natural Decline in Psarlapudi and Kesanapalli-W fields in Rajahmundry.

- Potential decline and ceasure of wells in Gandhar field in Ankleshwar Asset.

- S/D of OTPC unit#2 for Annual Maintenance since 23.05.2022 in Tripura.

- Decline in AG in Geleki field & FG in Laiplingaon field in Assam Asset.

- Natural gas production by OIL (Oil India Ltd) in the nomination block during June 2022 was 246.75 MMSCM which is 19.24% lower than the target for the month of current year but 7.22% higher than production of corresponding month of last year. Cumulative natural gas production by OIL during April-June 2022 was 742.78 MMSCM, which is 19.68% lower than target for the period but 10.01% higher than production during corresponding period of last year. Reasons for shortfall in production are as under:

- Low upliftment/demand of gas by the major customers.

- Less than planned contribution from drilling wells and old wells.

- Natural gas production by Pvt/JVs companies in the PSC/RSC/CBM regime during June 2022 was 928.80 MMSCM, which is 0.43% lower than the target for the month but 7.69% higher when compared the production of June 2021. Cumulative natural gas production by Pvt/JVs during April-June, 2022 was 2723.82 MMSCM, which is 2.1% lower than target for the period but 11.59% higher than production during corresponding period of last year. Reasons for shortfall in production are as under:

- AAP-ON-94/1 (HOEC): Production Shortfall due to Low consumer demand.

- CB-OS/2 (VEDANTA): Shortfall due to delay in Drilling campaign.

- MB/OSDSF/B80/2016 (HOEC) Production shortfall due to D1 well is shut-in due to operational issues and Plant shut-down multiple times due to process shut-down.

- RJ-ON/6 (FEL): Less offtake of gas by buyer for two days and natural decline from wells.

- RAVVA (VEEDANTA): Production shortfall due to RE wells were shut for rig move activities, leading to reduced monthly realization and Increased water cut in RE-5

- Crude Oil Processed (Crude Throughput)

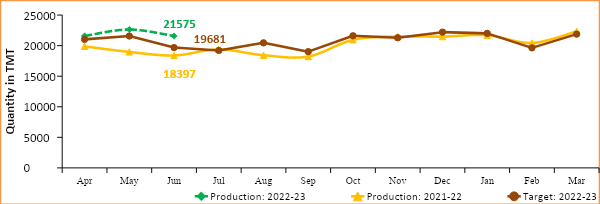

Crude Oil Processed during June 2022 was 21574.57 TMT, which is 9.62% higher than target for the month and 17.27% higher than the June 2021. Cumulative crude processed during April-June 2022 was 65798.09 TMT, which is 5.64% and 14.92% higher than target for the period and production during corresponding period of last year respectively. Refinery-wise details of the crude throughput and capacity utilization during the month of June 2022 vis-à-vis June 2021 are given at Annexure-III and Annexure-IV. Company-wise crude throughput for the month of June 2021 and cumulatively for the period April-June 2022 vis-à-vis same period of last year has been shown in Table-3 and month-wise in Figure-3.

Figure 3: Crude Oil Processed (Crude Throughput)

Table 3: Crude Oil Processed (Crude Throughput) (in TMT)

|

Oil Company |

Target |

June (Month) |

April-June (Cumulative) |

||||||

|

2022-23 (Apr-Mar)* |

2022-23 |

2021-22 |

% over last year |

2022-23 |

2021-22 |

% over last year |

|||

|

Target* |

Prod.* |

Prod. |

Target* |

Prod.* |

Prod. |

||||

|

CPSE |

154983.78 |

11870.45 |

13454.57 |

10464.97 |

128.57 |

38679.02 |

41319.46 |

33301.10 |

124.08 |

|

IOCL |

69999.90 |

5874.97 |

6276.80 |

5358.33 |

117.14 |

18092.31 |

18936.47 |

16721.43 |

113.25 |

|

BPCL |

37000.00 |

2695.00 |

2895.38 |

2467.58 |

117.34 |

9375.00 |

9559.88 |

8306.96 |

115.08 |

|

HPCL |

18920.85 |

1258.50 |

1633.54 |

785.28 |

208.02 |

4250.10 |

4809.55 |

2508.01 |

191.77 |

|

CPCL |

10300.00 |

600.00 |

972.61 |

645.55 |

150.66 |

2430.00 |

2882.25 |

2034.51 |

141.67 |

|

NRL |

2800.00 |

236.62 |

240.56 |

192.73 |

124.82 |

717.75 |

786.62 |

640.03 |

122.90 |

|

MRPL |

15900.00 |

1200.00 |

1428.97 |

1009.62 |

141.53 |

3800.00 |

4325.14 |

3070.48 |

140.86 |

|

ONGC |

63.04 |

5.36 |

6.72 |

5.88 |

114.40 |

13.87 |

19.55 |

19.70 |

99.27 |

|

Pvt/JVs |

94637.83 |

7810.72 |

8120.00 |

7932.04 |

102.37 |

23604.03 |

24478.63 |

23954.75 |

102.19 |

|

HMEL |

11451.93 |

941.61 |

1078.48 |

1062.92 |

101.46 |

2873.50 |

3229.52 |

3224.22 |

100.16 |

|

RIL |

63021.49 |

5219.35 |

5361.90 |

5219.35 |

102.73 |

15755.52 |

16184.00 |

15755.52 |

102.72 |

|

NEL |

20164.41 |

1649.76 |

1679.62 |

1649.76 |

101.80947 |

4975.01 |

5065.11 |

4975.01 |

101.8111 |

|

TOTAL |

249621.61 |

19681.17 |

21574.57 |

18397.01 |

117.27 |

62283.06 |

65798.09 |

57255.85 |

114.92 |

Note.Totals may not tally due to rounding off. *: Provisional

3.1 CPSE Refineries’ crude oil processed during June 2022 was 13454.57 TMT, which is 13.35% higher than target for the month and 28.57% higher than the production of June 2021. Cumulative crude throughput during April-June 2022 was 41319.46 TMT which is 6.83% and 24.08% higher than target for the period and production during corresponding period of last year respectively. Reasons for shortfall in production are as under:

- IOCL-Panipat Refinery: Crude processed lower due to high TAN crude processing.

- IOCL-Paradip Refinery: Crude processed lower due to GY tripping and INDMAX unit shutdown.

- HPCL-Visakh: Crude processed lower due to shutdown of a primary unit.

3.2 Private & JVs Refineries’ crude oil processed during June 2022 was 8120.0 TMT, which is 3.96% higher than the target for the month and 2.37% higher than the production of June 2021. Cumulative crude throughput during April-June 2022 was 24478.63 TMT, which is 3.71% and 2.19% higher than target for the period and production during corresponding period of last year respectively.

- Production of Petroleum Products

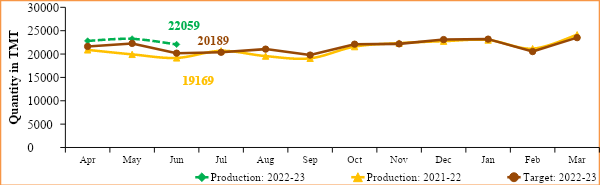

- Production of Petroleum Products during June 2021 was 22059.08 TMT, which is 9.27% higher target for the month and 15.08% higher than the production of June 2021. Cumulative production during April-June, 2022 was 68120.47 TMT, which is 6.27% and 13.55% higher than target for the period and production during corresponding period of last year respectively. Unit-wise production of petroleum products is given at Annexure-V. Company-wise production for the month of June 2022 and cumulatively for April-June, 2022 vis-à-vis same period of last year has been shown in Table-4 and month-wise in Figure-4.

Table 4: Production of Petroleum Products (TMT)

|

Oil Company |

Target |

June (Month) |

April-June (Cumulative) |

||||||

|

2022-23 (Apr-Mar)* |

2022-23 |

2021-22 |

% over last year |

2022-23 |

2021-22 |

% over last year |

|||

|

Target* |

Prod.* |

Prod. |

Target* |

Prod.* |

Prod. |

||||

|

CPSE |

144648.94 |

11031.97 |

12617.72 |

9771.63 |

129.13 |

36064.82 |

38793.80 |

31396.40 |

123.56 |

|

IOCL |

66322.30 |

5533.40 |

5959.39 |

5016.78 |

118.79 |

17148.15 |

18011.12 |

15964.32 |

112.82 |

|

BPCL |

34005.99 |

2463.83 |

2729.21 |

2323.75 |

117.45 |

8614.16 |

9015.59 |

7901.48 |

114.10 |

|

HPCL |

17495.57 |

1141.73 |

1455.73 |

793.33 |

183.50 |

3875.58 |

4412.01 |

2413.42 |

182.81 |

|

CPCL |

9614.24 |

561.39 |

970.88 |

569.50 |

170.48 |

2269.27 |

2704.00 |

1789.08 |

151.14 |

|

NRL |

2748.86 |

232.30 |

256.97 |

159.72 |

160.89 |

704.64 |

807.19 |

604.60 |

133.51 |

|

MRPL |

14401.95 |

1094.22 |

1238.97 |

902.84 |

137.23 |

3439.81 |

3824.99 |

2704.78 |

141.42 |

|

ONGC |

60.02 |

5.10 |

6.57 |

5.71 |

115.15 |

13.20 |

18.91 |

18.72 |

101.01 |

|

Pvt/JVs |

111404.56 |

8840.47 |

9112.28 |

9075.45 |

100.41 |

27130.27 |

28412.93 |

27574.68 |

103.04 |

|

HMEL |

10528.86 |

800.18 |

1043.03 |

1035.16 |

100.76 |

2617.31 |

3054.71 |

3061.71 |

99.77 |

|

RIL |

81492.18 |

6427.27 |

6488.83 |

6427.27 |

100.96 |

19718.00 |

20556.02 |

19718.00 |

104.25 |

|

NEL |

19383.52 |

1613.02 |

1580.42 |

1613.02 |

97.98 |

4794.97 |

4802.20 |

4794.97 |

100.15 |

|

Total Refinery |

256053.50 |

19872.43 |

21730.00 |

18847.07 |

115.30 |

63195.09 |

67206.73 |

58971.08 |

113.97 |

|

Fractionators |

3888.14 |

316.10 |

329.09 |

322.11 |

102.16 |

903.74 |

913.75 |

1021.66 |

89.44 |

|

TOTAL |

259941.64 |

20188.53 |

22059.08 |

19169.19 |

115.08 |

64098.83 |

68120.47 |

59992.74 |

113.55 |

Note: Totals may not tally due to rounding off. *: Provisional

Figure 4: Monthly Refinery Production of Petroleum Products

- Production of petroleum Products by Oil’s Refineries during June 2022 was 21730.0 TMT, which is 9.35% higher than target for the month and 15.3% higher than the production of June 2021. Cumulative production during April-June, 2022 was 67206.73 TMT, which is 6.35% and 13.97% higher than target for the period and production during corresponding period of last year respectively.

- Production of petroleum Products by Fractionators during June 2022 was 329.09 TMT, which is 4.11% higher than the target for the month and 2.16% higher than production of June 2021. Cumulative production during April-June, 2022 was 913.75 TMT, which is 1.11% higher than target for the period but 10.56% lower than production during corresponding period of last year respectively.

Click here to see Annexure-III

********

YB/RM