“Investments in infrastructure and Productive capacity have a large multiplier impact on growth and employment” said the Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman in Parliament today while presenting the Union Budget 2023-24.

Capital Investment as a driver of growth and jobs

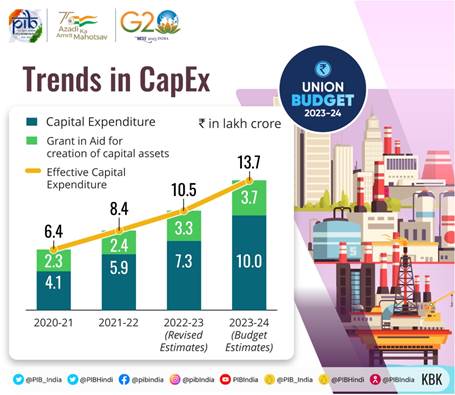

To ramp the virtuous cycle of Investment and job creation the budget took lead again by steeply increasing the capital expenditure outlay by 37.4 % in BE 2023-24 to whooping Rs.10 lakh crore over Rs. 7.28 lakh crore in RE 2022-23.

The Statements of fiscal policy highlighted that the capex is almost 3 times of the capital expenditure in FY 2019-20. The key infrastructure and strategic Ministries such as Road Transport and Highways, Railways, Defence, etc. will lead in driving the capital expenditure in FY 2023-24. According to fiscal policy it magnifies government’s thrust on infrastructure development through enhanced capital expenditure. It also seeks to ensure equity and equality of such investments across the country. This is in line with the Government’s focus and commitment to Four I’s – Infrastructure, Investment, Innovation and Inclusion in the next 25 years.

To strengthen the hands of the States in the spirit of cooperative fiscal federalism, the scheme for providing financial assistance to the States for capital expenditure introduced in FY 2022-23 has been extended in FY 2023-24, with the enhanced outlay of Rs.1.30 lakh crore. This represents an increase of 30 per cent over BE 2022-23 allocation and accounts to nearly 0.4 per cent of GDP of FY 2023-24.

Revenue expenditure

The budget notes that revenue expenditure is estimated to grow by 1.2 % at Rs. 35.02 lakh crore in 2023-24 over Rs. 34.59 lakh crore. Major components of revenue expenditure include interest payments, major subsidies, pay and allowances of government employees, pensions, defence revenue expenditure, and transfers to States in the form of Finance Commission grants, Centrally Sponsored Schemes, etc. Grants to Central autonomous bodies are a substantial part of the Central Sector schemes.

- Interest Payments

Interest payments are estimated to be Rs. 10.80 lakh crore which is 30.8 % of the total revenue expenditure.

- Subsidies

According to the fiscal statement subsidies form a significant portion of the Revenue expenditures which includes food, fertilizer, and petroleum subsidies. Major subsidies at Rs.3.75 lakh crore (1.2 per cent of GDP) is 10.7 % of Revenue Expenditure in BE 2023- 24.

- Finance Commission Grants

As per the budget the total FC grants under various categories, such as Revenue Deficit Grants to the States, Grant for Urban and Rural Local Bodies and others are estimated to the tune of Rs. 1.65 lakh crore in FY 2023-24.

- Pensions

The expenditure to witness rise to about Rs.2.45 lakh crore in RE 2022-23 from Rs 2.07 lakh crore in BE 2022-23. The main reason behind this increase in RE 2022-23 is clearing the dues of OROP with respect to Defence Personnel. Pension payments are expected to be at Rs.2.34 lakh crore in BE 2023-24, representing 0.8 per cent of the estimated GDP. This includes a provision of about Rs.1.38 lakh crore for defence pensions.

Total expenditure

The fiscal policy statement highlighted the total expenditure is to be Rs. 45.03 lakh crore in 2023-24; increase of 7.5% over 2022-23.

Devolution to states

The devolution to states under 15th finance commission to be about Rs. 9.48 lakh crore on account of increased tax receipts during the year and adjusting the amount of approximately Rs. 32,600 crore on account of prior period adjustments payable by the Union Government to the States. As per 15th FC recommendations, tax devolution to the States works out to be Rs. 10.21 lakh crore in BE 2023-24.

****

RM/ABB/PM